In recent news, we can read that the Reserve Bank of India is soliciting bids from companies to create a mobile app to identify currency to help visually impaired people. Unfortunately, as in most cases, bits and pieces of the news is picked up by online resources, and it is hard to trace it back to the original source. One of the most reliable resource I found was by The Hindu Business Line. This is relevant, because it was only last year that the RBI has started to explore how to make Indian Rupees accessible for the “visually challenged”. So, why is it necessary to create an app, and how will this app help? Before I would answer this question, let’s look at the history of accessible currency in India, because some of the answers go back to almost 20 years.

Historical overview of accessible currency in India

Indian Rupee banknotes have used different sizes and colors to help banknote identification. Besides these features, according to the RBI, the old Gandhi Series of notes contained tactile marks to further assist visually impaired people.

The following explanation can be found on the RBI site:

“A special feature in intaglio has been introduced on the left of the watermark window on all notes except Rs.10/- note. This feature is in different shapes for various denominations (Rs. 20-Vertical Rectangle, Rs.50-Square, Rs.100-Triangle, Rs.500-Circle, Rs.1000-Diamond) and helps the visually impaired to identify the denomination.”

Banknotes, however, which were issued later did not contain such features. Though a few notes maintained tactile features, such as the 200, 500 and 2000 Rupees, in practice it wasn’t sufficient for blind people to use banknotes independently. Even though there was some difference in size, it is not large enough to safely tell notes apart. Also, in day to day transaction, people tend to use the lower denomination notes.

What made matters worse was the simultaneous use of the old and new series.

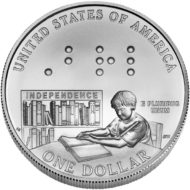

In 2018, the RBI made a promise to investigate how to make banknotes more accessible. This was a response of a pending court investigation. The RBI did not state how they are planning to make currency accessible. As it has been proven sufficient in the United States, a technological solution can be used to help visually impaired people to differentiate between notes if they are not able to do it by using limited vision or touch. At this point, the RBI is planning to do the same.

What is the real problem

At present, banknotes which are most widely used are impossible to tell apart by touch. Even those notes, which have tactile features can only be felt when the note is new and crisp. People need to use alternative solutions to identify their banknotes. At this time, there is little hope that all currency will be identifiable for all people in the near future. Unless the newly issued notes will be redesigned, tactile recognition will be out of the question.

And this brings us to the original question: how will a mobile app help blind people?

It is estimated that only over 300 million people currently use mobile phones in India, some of these are not smart phones which could run such an application. This is approximately the quarter of the population, though this number is increasing steadily. Another fact to consider is that often times, blind people have less opportunities for education and employment and they are more likely to face poverty, just like in many other countries of the world. Thus, such an application will only help those who are privileged to own a suitable smart phone.

It is true that theoretically using technology can make banknotes identifiable, it only works when technology is readily available. In the United States, there is Federal money to provide all eligible visually impaired people with a money reading device that can help them identify currency. It is rather unlikely that the government of India will issue mobile phones free of charge to all visually impaired people outfitted with a money recognition app.

How can people bridge the gap

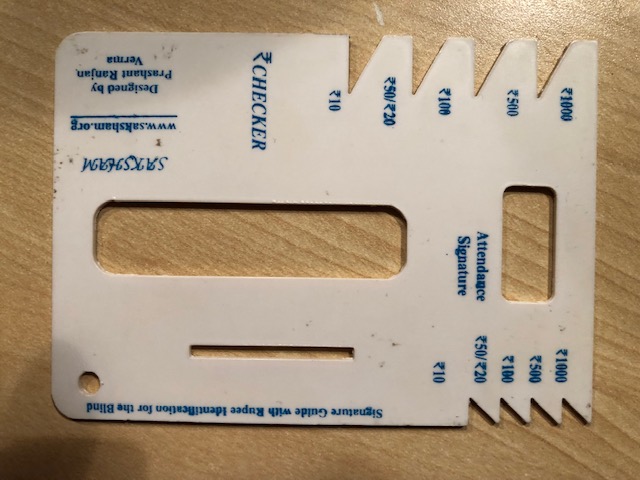

Until the problem is resolved, some solutions will be available to visually impaired people. When encountering less circulated notes, people will be able to identify the higher denomination ones. There is a slight difference in size, which is not large enough to tell notes apart just by touch, but people can use a money identification card like the one pictured below to measure their notes one by one.

This card is slightly older and will not work with the latest currency, but the modification of this card will solve this problem, and most likely it already does exist.

Another approach people will be able to take soon is to try using coins. As I have discussed earlier, the new coins of India will be more accessible, and larger denominations will be circulating as well, such as the 10 and 20 Rupees. Today though there are 10 Rupees coins, they are not widely used, and both of these denominations are found as banknotes.

Conclusion

India belongs to the minority of the countries which is working on making currency available for the blind and visually impaired. The effort on its own is wonderful, and a great step in the right direction. However, the new notes and the app planned to be developed are far from solving the problem visually impaired people are facing when using currency.

I like the card solution. It is simple and It may do the job right. For countries like India, this solution can be better than a smartphone app.

Absolutely, I just read yesterday that the court in India is asking the Reserve Bank if they are going to distribute phones with the app? Of course, even if they did, which I doubt, the next question will be connectivity.

Totally agree. That’s another problem that they should work on.