I’ve been writing about currency recently. No worries, we will get back to coins soon, but this is an interesting topic and deserves some discussion. I am researching the topic in greater detail, so probably I will have more to say about it. So, today, I would like to write about what is really accessible currency, why does it matter, and will also discuss an alternative approach.

Accessible basically means that it is usable to all. When it comes to currency, accessible mostly means that all people with any physical limitations should still be able to recognize currency. Though some limitation can be the ability to read, but mostly it has to do with visual impairment. If a nation’s different banknotes feel and look identical, people with limited or no vision will not know the value of the currency. There are some alternative methods, earlier I wrote about how blind people identify paper currency. Ideally, alternative methods should not be required.

Paper money can be accessible when there is a large enough difference between the notes either lengthwise or widthwise or both so that people can easily differentiate them by touch. Another method is to use tactile dots, lines or other marks to differentiate notes. For people with limited vision, easily distinguishable colors and fonts will be important as well. The problem with this is when the notes are older and more used, these marks tend to fade away soon. There are other methods which were used, but I have to say that so far all of them had some limitations. So far my favorite is the Canadian Dollar, which uses groups of dots depending on the value of the banknote, so groups of dots take longer to fade than individual dots or markings. The other advantage is that Canada uses polymer notes, which are more durable than many other currencies.

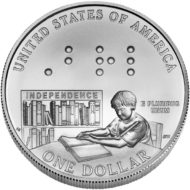

In case of coins, the problem is not as relevant, because it is possible to mint coins which people can easily tell apart. However, the difficulty greatly varies among coins, some countries use coins which are much harder to tell apart, such as in India, read more about it here.

But what is really the problem with currency?

The real problem, however, is not necessarily that blind people are not able to differentiate the banknotes. The problem is that they are therefore not able to easily give the right payment, or securely check if they got the right amount back. If this problem could be solved easily the level of currency accessibility would not matter that much. These days there are many currency identification devices and apps, which can be helpful when a particular currency is not accessible. The issue here is that these devices are very expensive, they can cost hundreds of Dollars. In the US the National Library Service provides such a tool for qualified visually impaired people free of charge, but this is not the case in most countries. Of course, people can use phone apps to recognize currency, but we cannot assume that all people who make payments will have a phone available to them.

Interestingly, the problem seems to be able to solve itself with the introduction of electronic payments. People can use credit cards or phones to make payments instead of currency, but again, this only helps those who have a phone. One can set up a service to receive a text message with the paid amount when a credit card transaction is made. Therefore, they don’t have to worry about giving or receiving the right amount, while paying safely because they can’t be charged inappropriately. Throughout my travels around the world, I was able to use my credit card. Being a coin collector, I often decided to use coins and paper money, but often I didn’t have to.

It still does not mean that currency should not be accessible, but at least, we will more and more have an alternative method, which can be useful in countries where currency is hard to identify.